Business Valuation

Excel and Google Sheets Template

What's Inside the Business Valuation Template?

Details | 4 Sheets

Supported Versions | Excel 2010, 2013, 2016, 2019, Office 365 (Mac), Google Sheets

Category | Management , Finance

Tags | Acquisitions, Merger, Small Business

Why Professionals Choose Simple Sheets

It's simple. Access to the largest library of premium Excel Templates, plus world-class training.

100+ Professional Excel Templates

Optimized for use with Excel. Solve Excel problems in minutes, not hours.

World-Class Excel University

With our university, you'll learn how we make templates & how to make your own.

How-To Videos

Each template comes with a guide to use it along with how-to videos that show how it works.

Inside Our Business Valuation

Excel and Google Sheets

Template

If you’ve seen Shark Tank, you know putting a valuation of a business is half science and half art. Mr. Wonderful is far more likely to slash a valuation in half whereas Mark Cuban will gladly pay full price if he sees potential.

While the ‘art’ part relies on storytelling, innovation and a growing market, the science is in the numbers.

Our Business Valuation Excel Template makes it easy to identify the financial health, future and valuation of a business based on the data. By providing three revenue scenarios ranging from optimistic to pessimistic, you can go into a negotiation having an idea of the risk, upside and conservative viewpoints of a business.

Before we dive into how to use this template, you may also want to check out our Cash Flow Planning, SaaS Metrics Dashboard, Cap Table and Sales Trend Analysis templates. Each can be used for calculating key metrics like equity, investments, churn, recurring revenue, subscribers and more.

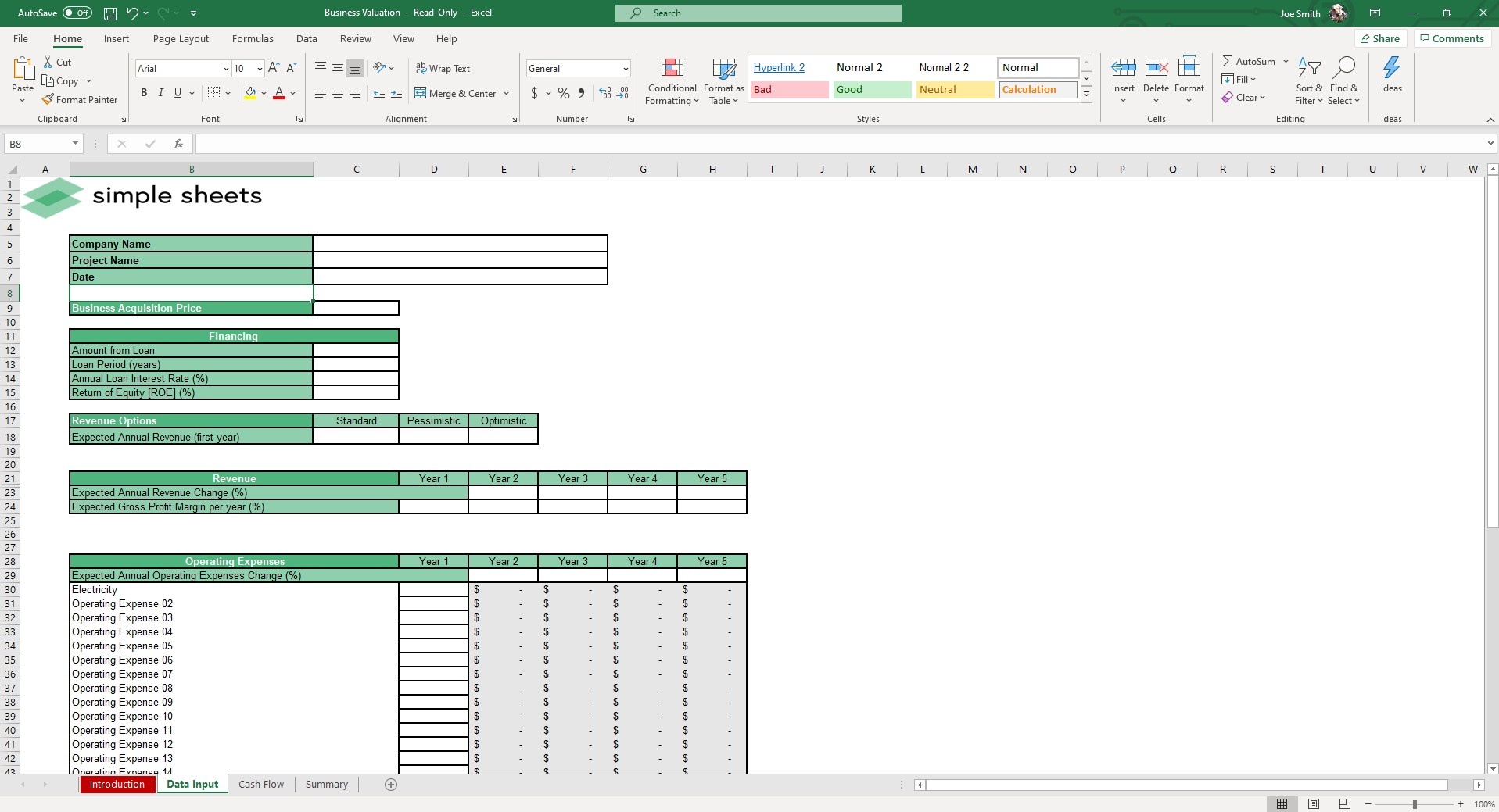

Start from the Data Input sheet. Fill in the fields that are highlighted white. The fields that are highlighted gray are calculation cells so avoid messing with those.

A few of the headers you can expect to fill out: Financing, Business Acquisition Price, Revenue Options, Operating Expenses, Working Capital, Capital Expenses and Company Name.

Once you’ve input all your data, the template will auto populate like magic.

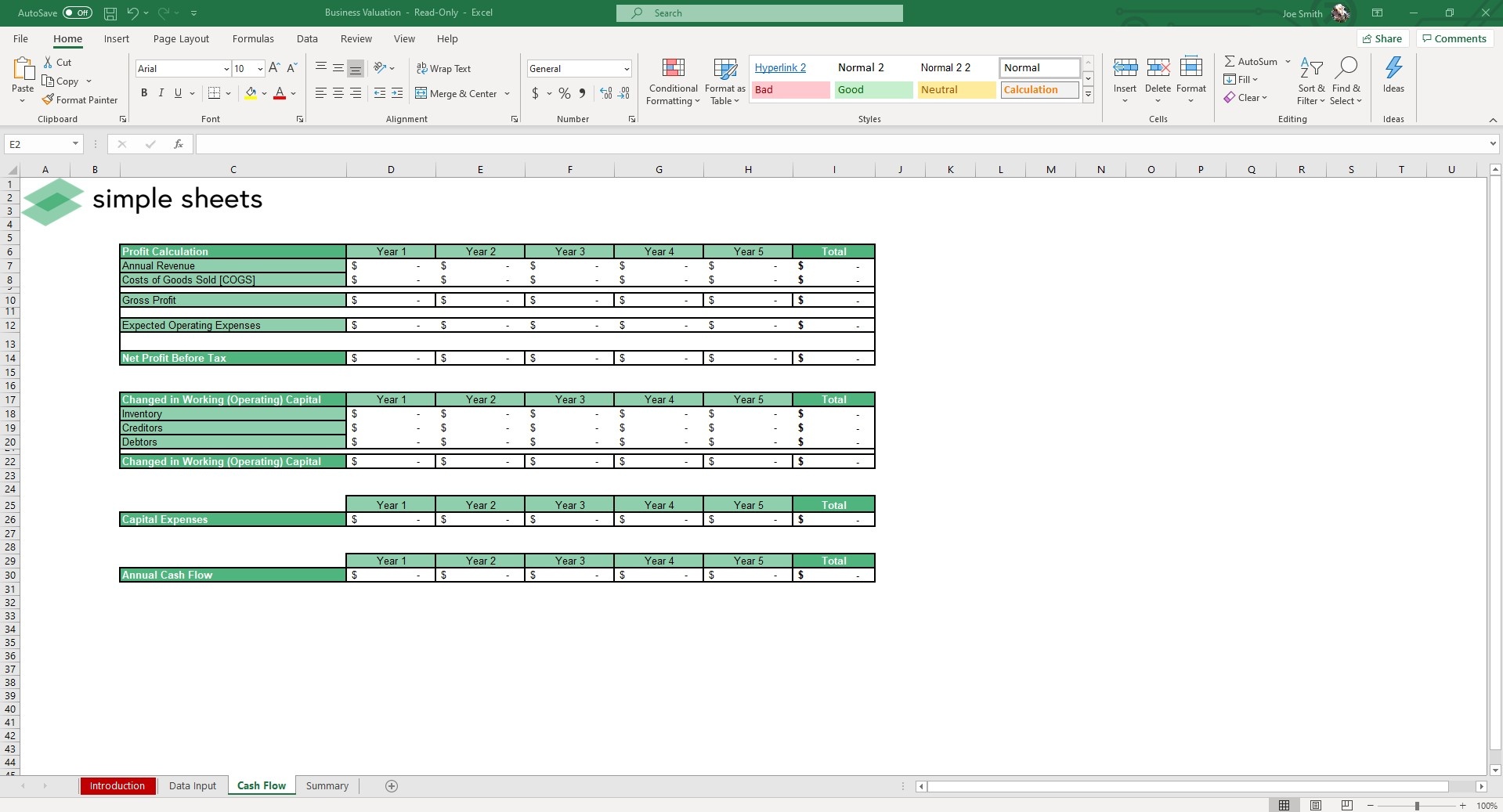

The Cash Flow sheet will calculate metrics like Net Profit Before Tax, Change in Working Capital, Capital Expenses and Annual Cash Flow.

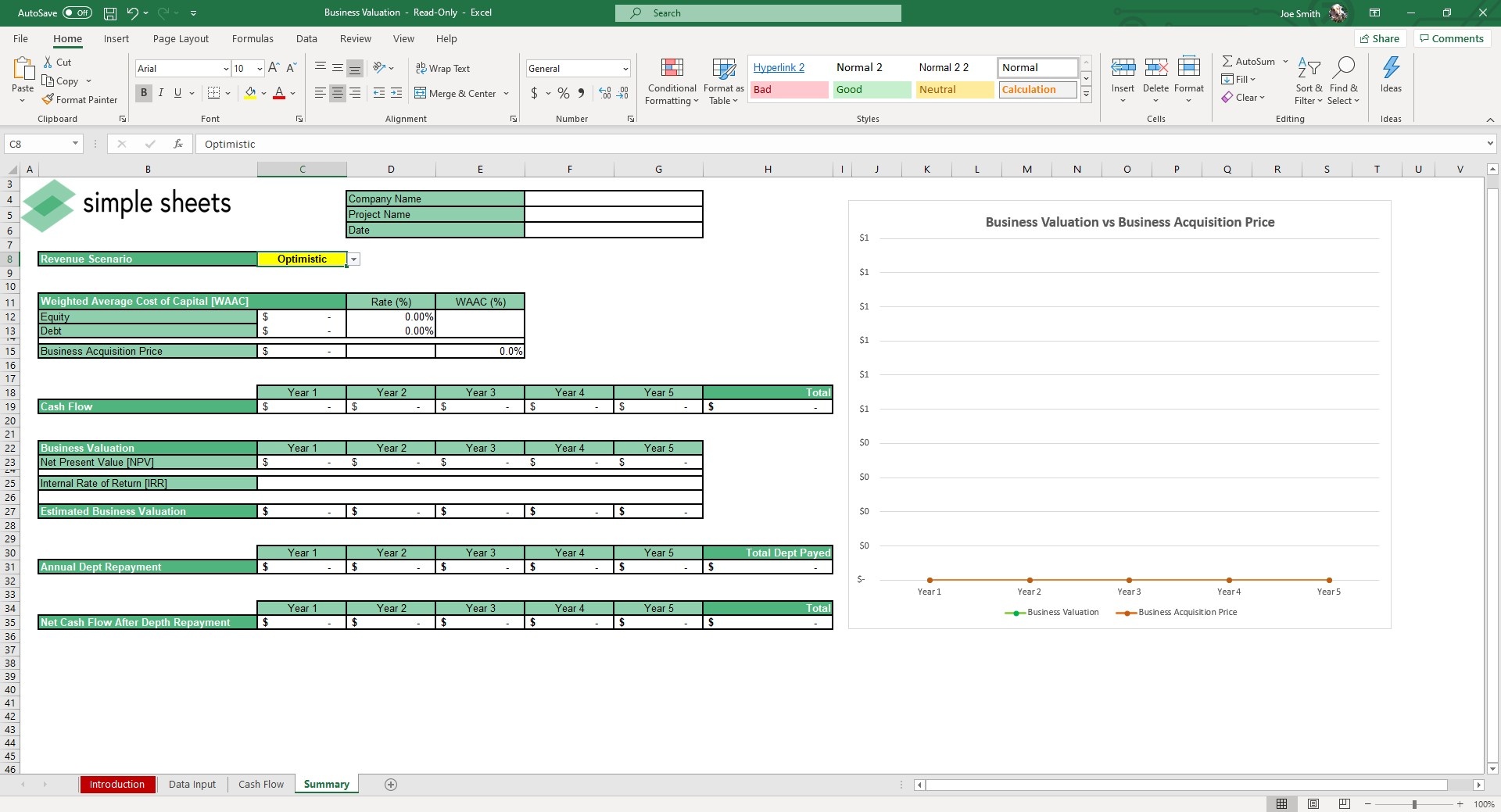

Navigate over to the Summary tab, also pre populated from your numbers in the Data Input sheet. Cell C8 is a dropdown menu that displays either a Pessimistic, Optimistic or Standard revenue scenario.

The most important metrics when it comes to business valuation will be automatically calculated, numbers like Cash Flow, Net Present Value, Internal Rate of Return, Estimated Business Valuation, Annual Debt Repayment and Net Cash Flow After Debt Repayment.

To the right of those tables is a chart that measures the Business Valuation vs Business Acquisition Price.

Whether you’re buying or selling a business, this template provides automated formulas, graphs and a proven methodology for calculating a business with Microsoft Excel.

If that wasn't enough reason to get this template, did you know this template is compatible with Google Sheets? Collaborate with your co-workers in real time and enjoy the cloud auto-save feature of Sheets when you use this template!